- ThetaThrottle

- Posts

- The Cost Basis Game

The Cost Basis Game

Weekly Edition: October 8th, 2025

Market Movements

Weekly Return | Current Level | |

|---|---|---|

S&P 500 | 0.745% | 6,714.59 |

NASDAQ | 1.142% | 22,788.36 |

Dow Jones | 0.509% | 46,602.98 |

VIX | -0.174% | 17.25 |

Russell 2000 | 1.243% | 2,458.42 |

*Weekly Return is calculated as market open of the previous Wednesday, to market close this Tuesday (yesterday); Current Level is Tuesday’s (yesterday’s) close.

Weekly Rollout

Markets are limping into the week, with the Dow dragging its feet and tech slipping on Oracle’s stumble. The Fed isn’t helping matters. A government shutdown has cut off the usual data drip of jobs and inflation reports, leaving policymakers to debate rates in the dark. Investors, meanwhile, are left clutching at oil prices, bond yields, and trade updates as substitutes for a clear economic compass. Not exactly a comforting set of guideposts.

Elsewhere, the corporate and commodities world is buzzing. Big banks and healthcare giants headline this week’s earnings calendar, while AMD scored a headline-grabbing partnership with OpenAI in the ongoing AI chip war. On the “hard assets” side, Ken Griffin is side-eyeing a modern-day gold rush, warning it reeks of anxiety more than confidence. And for those who think gold feels old, Bitcoin traders are already dreaming bigger. Option bets on Bitcoin are stacking up at $140,000 after the weekend’s record-breaking rally. Safe havens and speculative rockets—take your pick.

“Good-To-Know’s”

Adjusted Basis (The IRS vs the Options Community) — The IRS talks about “adjusted tax basis,” which is the official number you must use when reporting gains or losses. It reflects your purchase price, plus or minus things like reinvested dividends, corporate actions, and—importantly for us—premiums if you’re assigned. This directly affects the taxes you owe.

But traders and investors often think in terms of an “effective cost basis.” It is casually referred to and given many other names (adjusted basis, net entry price, breakeven price, premium-adjusted price, etc.), but the point is that this isn’t a tax number. It’s more of a mental framework.

Every CSP premium collected or covered call sold can be viewed as lowering the real cost of owning those shares. If you sold a put on SOFI at $20, collected $1.25 in premium, and were assigned at expiration, most traders would say your effective basis is now $18.75.

Sometimes this number matches the IRS’s “Adjusted Tax Basis,” but it isn’t all that common. And the IRS doesn’t care about your mental accounting.

As options connoisseurs, however, tracking your effective basis is one of the best ways to measure progress and orient your portfolio properly. This keeps you informed as you continue shaving down your cost, and eventually, you’re holding a stock at a discount no one else has.

Quote(s) I Like

“Do not save what is left after spending, but spend what is left after saving.”

“Little by little, one travels far.”

Thought Throttle

So many traders view portfolios through a short-term lens. This is true not just in option selling, but across nearly all of finance. The problem is summed up in one word—shortsightedness.

Because traders want outsized returns now instead of letting things build consistently over time, many never dip their toes into selling options. They chase “pie-in-the-sky” 0DTE gambles instead of building something steady.

I can’t tell you how many times I’ve shown people the numbers and power of compounding option premiums. Often, we’re talking about annual returns in the 25–30% range, and yet they scoff as if it’s pennies.

The classic reaction? Seeing a $100 premium earned on thousands of dollars of collateral, and thinking it’s absolutely meaningless. But here’s the shift in perspective. Rather than viewing it as “just $100 income,” think of it as $1 per share shaved off your cost basis. That changes the game. Suddenly, you’re focused on the long-term position rather than the short-term win.

This way of thinking fuels a longer, more sure-footed path toward building your portfolio into all that it could be. Options aren’t just income, but they’re an engine for lowering your effective cost of ownership.

An Illustration…

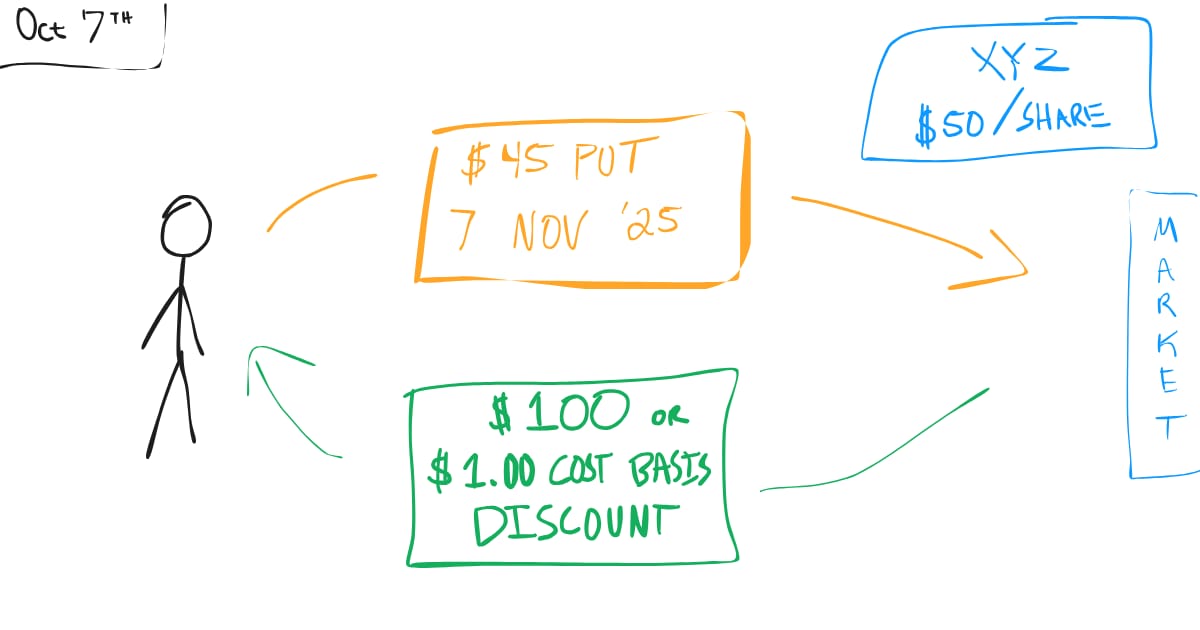

Let’s say XYZ is trading at $50 per share. We decide to sell the $45 strike put expiring November 7th and collect a $1 premium ($100 total). We only do this if we believe XYZ would be a good purchase at $45.

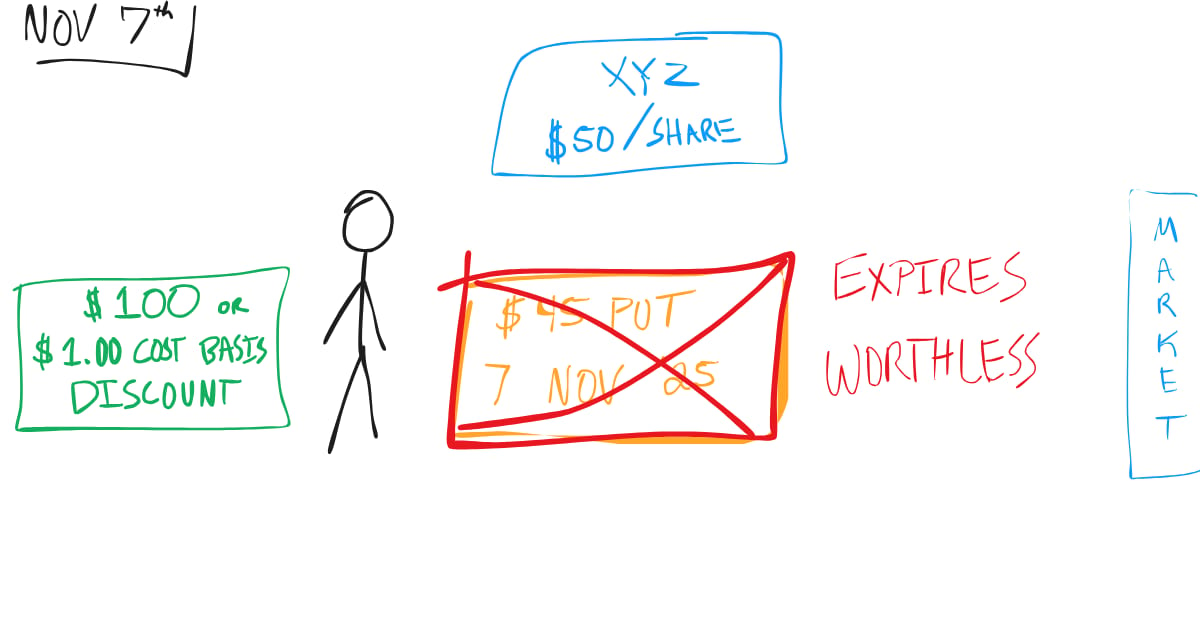

Now, November 7th rolls around. XYZ is still $50, so our option expires worthless. Instead of just seeing this as $100 income, we can also count it as lowering the eventual cost of buying XYZ, since we’re bullish on the stock anyway and will continue selling puts until we are assigned.

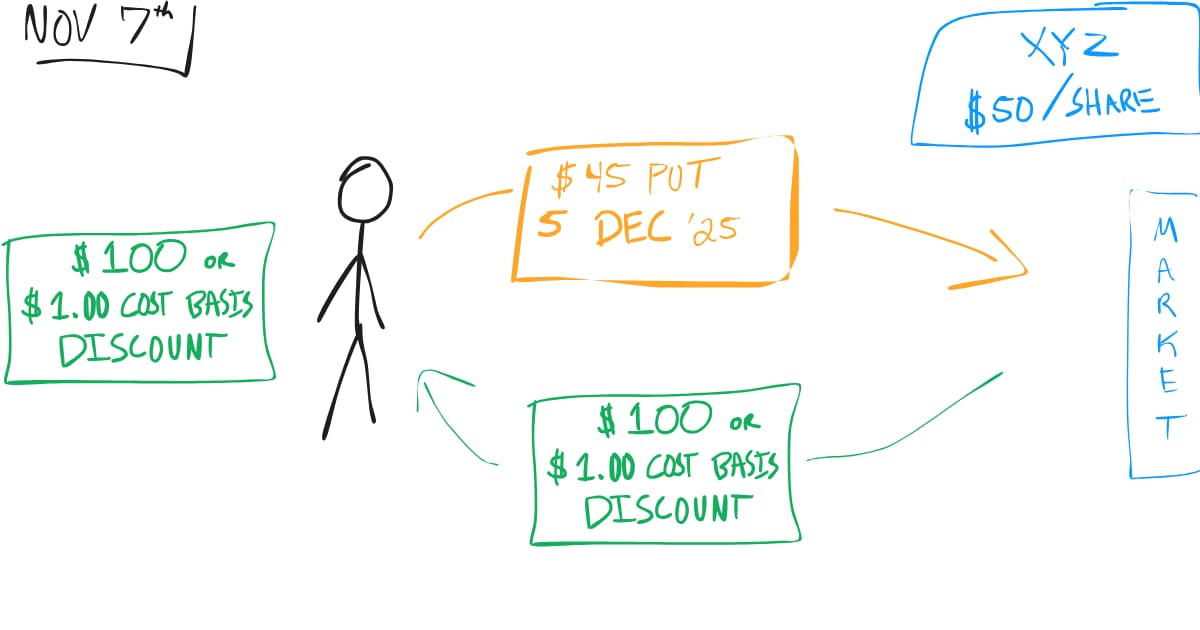

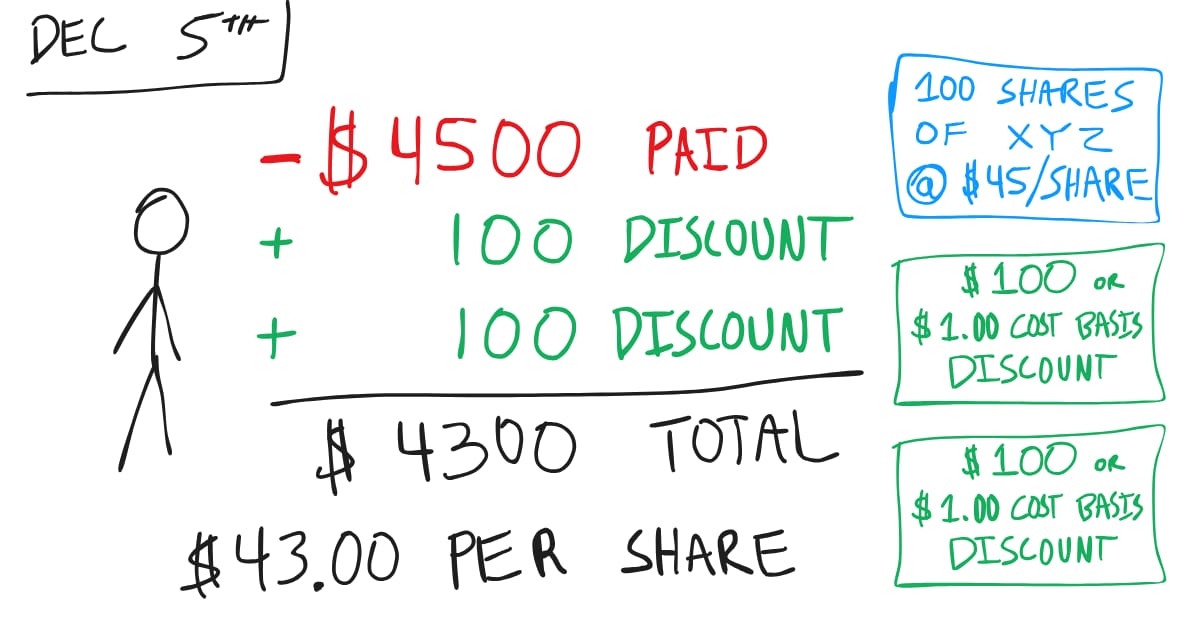

With the November contract done, we turn around and sell another $45 strike put expiring December 5th, again for a $1 premium, or $100. We now have $200 collected in premium, representing $2.00 in “cost basis discounts.”

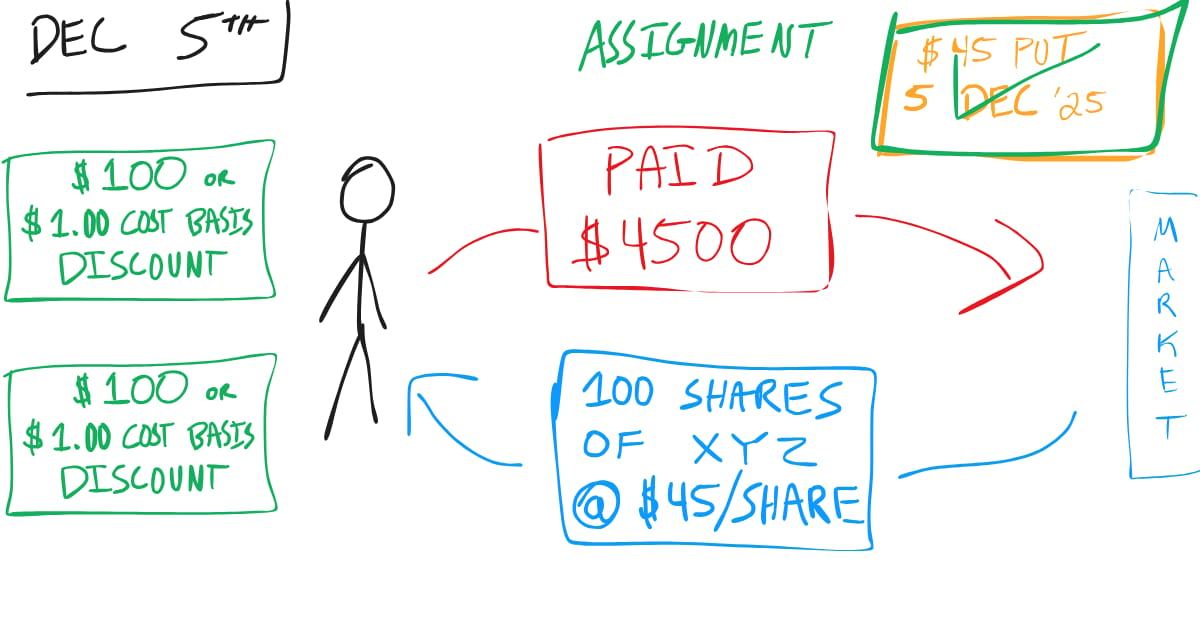

This time, December 5th comes, and XYZ has dropped to $44. We’re assigned, so we purchase 100 shares at $45.

Because we received two rounds of premiums ($200 total), our effective cost basis isn’t $45. It’s $43 per share. In other words, we got to enter the trade at a price well below the $50 market level from when we began.

From here, with 100 shares in hand, we could sell covered calls to continue shaving down our cost basis even further. Over time, that compounding effect is how selling options builds long-term advantage.

Why This Matters

Options don’t always “click” right away. But when people see how premiums directly lower cost basis, it often unlocks a new mental model.

It’s also important to note that the effective cost basis is only a framework for how to think about your portfolio and how you describe your gains and profits. It is not how the IRS sees it. Options that expire worthless or are rolled are taxed as short-term income. Only if you’re assigned does the premium adjust your official cost basis. More tax details in the Throttle Q&A.

So in the XYZ example above, the November put premium would be taxed as ordinary income (worse, higher tax rates). But once we’re assigned in December, that premium lowers the tax-adjusted cost basis of the shares. In tax terms, we’d have a $100 short-term gain plus 100 shares of XYZ at an adjusted basis of $44 for tax purposes.

As we know, trading is as much mental as it is technical, and this framework helps keep your focus on the bigger picture rather than chasing quick hits. So it is worth a mention. It might give you some much-needed perspective.

That’s the mental vs. tax distinction: one keeps you patient, the other keeps you compliant.

Trade Mechanics

In this example, let’s look at a cash-secured put on Hims & Hers Health (HIMS). The stock has been showing strong growth momentum, but we want to buy at a price closer to $50 per share. To position for this, we can sell the $49 put option expiring in 45 days.

Why the $49? Both the $50 and $49 puts are liquid, but the $49 strike comes with a slightly lower delta (≈25 vs. 28). For those who are unsure what delta is, in simple terms, delta reflects the probability of assignment (along with countless other things).

So, in short, the $49 put has a slightly lower delta and is less likely to be assigned, while still offering a compelling premium.

HIMS | |

|---|---|

Current Price | $57.97 |

Put Sold | Nov 21 ’25 $49 (~25 Delta) |

Premium | $3.95 |

Capital At-Risk | $4,505 |

Return if Not Assigned | $395 / 4,505 = 8.77% |

Annualized Return | ≈ 97.7% |

Cost Basis if Assigned | $45.05 |

Theta | -7.37 (≈+$7 per day) |

This trade offers a hefty 8.77% return in just 45 days, which annualizes to nearly 97.7%. That eye-popping figure should immediately remind traders—such high returns almost always come with high risk. Option premiums are elevated because the market is pricing in serious uncertainty.

If assigned, your effective cost basis drops to $45.05, giving you a cushion well below the $50 target entry. Meanwhile, the theta of -7.37 works in your favor as the seller (Theta, woohoo!). With each passing day, all else equal, this Put bleeds about $7 in premium, accelerating as expiration approaches. Good news for us sellers.

The risk, of course, is that HIMS trades sharply below $49. For some, that’s a welcome chance to own shares at a steep discount. For others, the volatility may be more than they want on their plate.

That’s the dual nature of selling puts. You’re getting paid while waiting for a price you’d be comfortable owning at.

This is for educational purposes only—not a trade recommendation. Remember to always do your own due diligence and consult a financial advisor before making investment decisions.

Throttle Q&A

Taxation on Options Summarized:

Situation | Buyer of Option | Seller of Option |

|---|---|---|

Sell option (before expiration) | Gain/loss is capital. Short-term if held ≤ 1 year, long-term if held > 1 year. | Premium received = short-term capital gain, regardless of holding period. |

Option expires worthless | Premium paid = capital loss. Short-term if held ≤ 1 year, long-term if held > 1 year. | Premium kept = short-term capital gain. |

Call exercised or assigned | Premium paid = added to stock cost basis. Holding period for stock starts the day after exercise. | Premium received = added to sale proceeds of the stock delivered (taxable on stock sale). |

Put exercised or assigned | Premium paid = subtracted from stock sale proceeds (if selling shares). | Premium received = subtracted from stock purchase cost basis (no tax until stock is sold). |

Check out our two previous posts for more on the taxation of sold options:

Should I Change My Delta Target When Markets Are Volatile?

Volatility doesn’t just affect prices, but it affects strategy too. In higher-volatility environments, even lower-delta options pay well. If you typically sell 20-delta puts, shifting to 15-delta during uncertain weeks might still give you strong returns with a wider safety margin.

But remember: lower delta means a lower chance of assignment. So ask yourself, do you want to own the stock, or just collect premium? Your delta should reflect your intent, not just the market’s mood.

Don’t Forget the Fundamentals

Simply, don’t forget the foundation of fundamental analysis. Disregard this at your own peril.

Selling options is powerful, but without conviction in the company’s balance sheet and growth prospects, you’re just collecting premium on a weak hand. Pairing solid fundamentals with options is what turns cost-basis trimming into a durable, long-term strategy.

You have to do the work. Your portfolio depends on it.

Check out this previous edition for more:

Got any questions or comments? Feel free to reply to this email—we’d love to hear from you!

If you found this helpful, feel free to share or forward this email to anyone who might be interested! We appreciate your support.

Disclaimer

The information provided in this newsletter is sourced from reliable channels; however, we cannot guarantee its accuracy. The opinions expressed in this newsletter are solely those of the editorial team, contributors, or third-party sources and may change without prior notice. These views do not necessarily reflect those of the firm as a whole. The content may become outdated, and there is no obligation to update it.

Options come with inherent risks. We strongly advise you to consult with a financial advisor before making any investment decisions, including determining whether any proposed investment aligns with your personal financial needs.