- ThetaThrottle

- Posts

- Tax-Free Premiums? Yes.

Tax-Free Premiums? Yes.

Weekly Edition: October 1st, 2025

Market Movements

Weekly Return | Current Level | |

|---|---|---|

S&P 500 | 0.280% | 6,688.46 |

NASDAQ | 0.018% | 22,660.01 |

Dow Jones | 0.062% | 46,397.89 |

VIX | -1.750% | 16.28 |

Russell 2000 | -0.928% | 2,436.48 |

*Weekly Return is calculated as market open of the previous Wednesday, to market close this Tuesday (yesterday); Current Level is Tuesday’s (yesterday’s) close.

Weekly Rollout

Markets ended Q3 in the green, with the S&P 500 up 0.41% and the Nasdaq inching 0.30% higher, despite clear signs of economic stress. Consumer confidence dropped to 94.5, and August job growth barely cracked 22,000, with prior months revised lower—signaling a cooling labor market. Yikes.

Pharma stocks like Pfizer climbed after Trump teased a new drug pricing plan, and Goldman Sachs flagged a surge in ETF demand from wealthy investors, particularly in gold, crypto, and AI exposure.

Meanwhile, a government shutdown is all but certain, with no deal in place as deadlines passed. The impact will likely stall key economic data and rattle market expectations. Add in rising volatility, with $1.5T in algo-driven trades poised to move on momentum, and traders may need to reassess risk heading into Q4.

“Good-To-Know’s”

Option Selling Premiums Taxation — Most option premiums received are taxed as short-term capital gains, even if the contract lasts more than a year. The IRS treats writing options (selling puts, selling covered calls) as creating short-term income, not long-term capital appreciation. They always kill the fun.

That means if your option expires worthless or you close it early for a profit, that income is taxed at your ordinary income rate, not the more favorable long-term capital gains rate. The only time you get a different treatment is when you’re assigned shares. The premium would adjust your cost basis or sale price, which is taxed when you eventually sell the stock.

Because of this, tax-advantaged accounts like IRAs and Roth IRAs can be powerful tools for option sellers. By trading inside these accounts, you can avoid the annual tax drag and let premium income compound without Uncle Sam taking a cut each year. Onward.

To see last week’s edition that went deeper on taxation of premiums, click below:

Quote(s) I Like

“The hardest thing in the world to understand is the income tax.”

“A fine is a tax for doing something wrong. A tax is a fine for doing something right.”

Thought Throttle

Trading options puts you squarely in the world of potential—potential profits, potential losses, and most of all, potential tax surprises. Most traders get caught up in this way of thinking, but what if there was one tweak that would literally allow you to measure your savings in black and white?

That’s the beauty of tax-advantaged accounts and the importance of tax planning.

Unlike projecting and speculating how much an options trade may return (I love this too, don't get me wrong), the tax savings from using the right account type are tangible and, more than occasionally, substantial. It’s why financial planners and advisors often spend more time talking about accounts and tax treatment than they do individual investments.

So how do we save money on taxes?

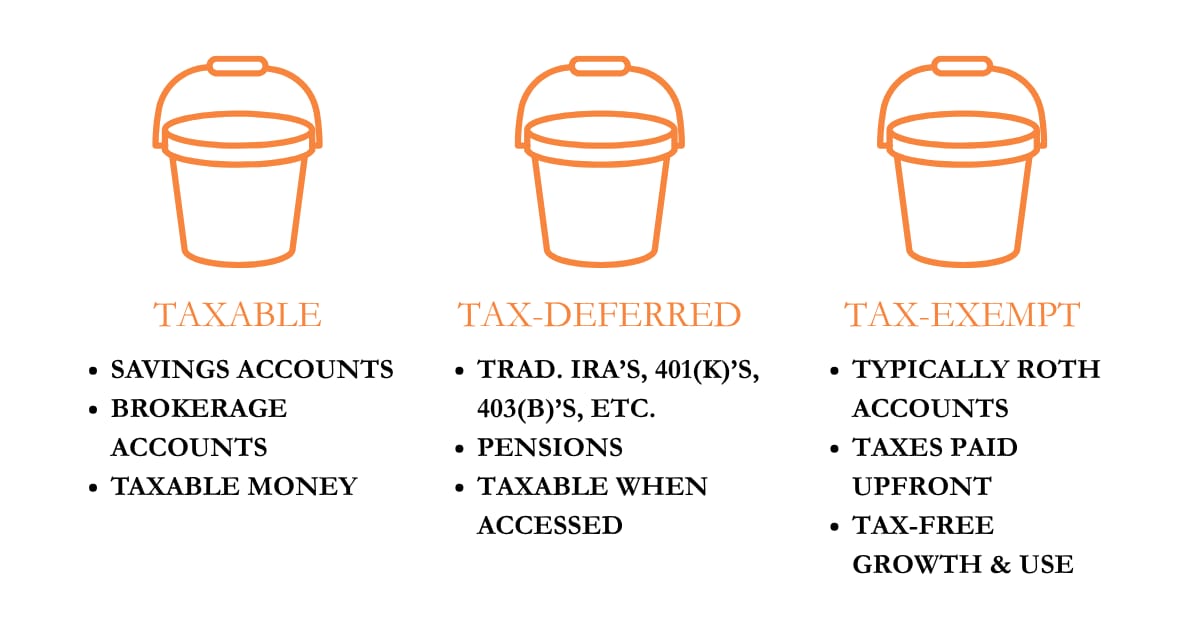

It starts with understanding the three tax buckets:

Taxable (normal brokerage accounts)

Tax-Deferred (like Traditional IRAs or 401(k)s)

After-tax or Tax-Exempt (aka Roth IRAs and Roth 401(k)s)

Bucket #1: Taxable (a.k.a. “Normal”)

This is your standard brokerage account. There are no upfront tax breaks, and all your gains—like the premium from selling options—are taxed in the year they occur. These accounts are also called non-qualified accounts because they don’t qualify for special tax treatment. Last week’s edition covered how options are taxed in these accounts, very often at short-term capital gains rates (less ideal), no matter how long you hold the trade. Look back at the "Good-To-Know" for more, also.

Bucket #2: Tax-Deferred (401(k), Traditional IRA)

These accounts let you contribute pre-tax dollars, which reduces your taxable income today. Your investments grow tax-free, and you pay ordinary income tax when you eventually withdraw the funds. Most people have access to this bucket through their employer’s 401(k), and it's one of the most commonly used accounts in America. You are simply backing out the taxes today, and committing to paying the taxes later.

Bucket #3: Tax-Exempt or After-Tax (Roth IRA, Roth 401(k))

With Roths, you contribute after-tax dollars—you pay taxes on the money upfront. But once the money’s inside the Roth, it grows completely tax-free. You don’t pay tax on gains, and you don’t pay tax when you withdraw the funds (as long as the rules are followed). That makes Roth accounts ideal for high-growth or high-risk strategies like selling options. You're taking the risk, why not keep all the reward?

Because of this, many traders choose to sell CSPs or covered calls inside Roth IRAs. It lets those gains stack tax-free, without Uncle Sam constantly asking for a slice. That said, there’s no one-size-fits-all answer here. Plenty of option sellers use taxable or tax-deferred accounts, too. It depends on your income, age, tax bracket, and goals.

Let’s walk through an example using all three buckets and see how it actually plays out.

Assume you earn $60,000 per year, and you’re setting aside $7,000 to trade options as a one-time investment (year 0), and you’re in the 22% federal tax bracket. Let's see how your investment performs in a taxable, tax-deferred, and after-tax (Roth) account.

Year 0: The Tax Setup

Before you even place a trade, your account choice affects how much income gets taxed. If you use a taxable or Roth account, your full income of $60,000 is taxed.

But if you contribute $7,000 to a tax-deferred account (like a Traditional IRA or 401(k)), your taxable income drops to $53,000. At a 22% tax rate, that’s about $1,540 in immediate tax savings. Bada-Bing, Bada-Boom.

Disclaimer: To keep this example simple, we’re ignoring standard deductions, state taxes, and other credits. Taxes can get complicated—this is just to illustrate broad differences between accounts.

Now let’s assume that $7,000 is invested for 10 years, earning 1% monthly from selling options (~12.7% compounded annually). Here’s how it plays out in each account:

In a taxable account, you pay taxes on your gains every year, usually at your ordinary income rate. Assuming a 22% short-term capital gains tax, your account grows more slowly due to that consistent tax drag. After 10 years of compounding at 1% monthly, your $7,000 investment grows to $17,979, with approximately $5,123 paid in taxes along the way. You’re left with less overall, simply because the US takes its cut year after year.

In a tax-deferred account like a Traditional IRA or 401(k), your full $7,000 compounds without interruption. The account grows to the same $23,102, but you’ll owe taxes when you withdraw the funds later in life. At the same 22% tax rate, that leaves you with roughly $18,020 after taxes. This is a bit more than the taxable account, thanks to the benefit of deferral and compounding before the tax hit.

In a Roth (after-tax) account, you pay taxes on your income up front, so there’s no immediate tax deduction. But once that $7,000 is inside the account, it grows tax-free. After 10 years, your investment still reaches $23,102, but this time, you owe nothing when you withdraw it. You keep all of it—no tax on the gains, no tax on the withdrawal. That’s the power of the Roth.

If you're selling options month after month, choosing the right account isn't just a “paperwork” thing, it's a “real dollars in your pocket” thing. This is a very high-level comparison, so it is imperative that you do further research and/or speak with a tax professional. This is just meant to open your eyes. Get to it.

Trade Mechanics

Let’s dive into a trade setup with SoFi Technologies (SOFI), a fintech star well known in the option trading community. If we want to get into SOFI at a discount (current price is $26.42), we can enter a Cash-Secured Put (CSP).

If we sell the Nov. 7th '25 $23 Strike Put, we would pull in $97 in premium. With a delta of about 25 on this option, that leaves us with a roughly 75% chance of expiring out-of-the-money (OTM), which happens if SOFI stays above $23. For this trade, we would need $2,203 in cash ($2,300 cost for 100 shares - $97 premium received).

If unassigned, we would earn a 4.4% return ($97 ÷ $2,203) over 38 days, annualizing to 51.27%. If SOFI drops below $23, we would be assigned shares at a $22.03 cost basis ($23 - $0.97), a 16.6% discount from the current price of $26.42. Substantial risk does occur if SOFI falls past our strike. This highlights the importance of choosing quality underlying businesses.

Overall, this shows the attractiveness of selling CSPs on underlyings that we believe in. As always, this is not advice or a recommendation, only an educational example.

2.0 Version

If we were confident that SOFI also won’t climb past $30 by November 7, we could boost our return with a jade lizard. This is done by adding a call spread on the other side of the put. We would sell the Nov. 7th '25 $30 Strike Call for $1.26 and buy the $32 Strike Call for $0.86, netting $0.40 ($1.26 - $0.86) in premium received.

Combine this with the $0.97 put premium, and our total net premium is $1.37 per share ($97 + $40). This is a 6.33% return over 38 days, or 80.32% annualized if unassigned. Our breakevens are $21.63 ($23 - $1.37) on the downside and $31.37 ($30 + $1.37) on the upside. We would want the stock's price to remain in that range, ideally.

I prefer the CSP’s simplicity, but the jade lizard offers extra premium for those who can navigate multi-leg complexity. It is worth knowing and illustrating how we can use options to tailor and fine-tune our trades.

Keep in Mind...

There are, of course, risks, including wider spreads, higher commissions, and trickier execution. Premiums can shift with SOFI’s earnings or market volatility, and returns assume no early assignment or slippage. Be ready to own 100 shares if the put is assigned or manage the call spread if SOFI spikes. Less liquid options may have wider spreads, and premiums are typically taxed as short-term gains.

This is for educational purposes only—not a trade recommendation. Remember to always do your own due diligence and consult a financial advisor before making investment decisions.

Throttle Q&A

What trades are allowed, and not allowed, in tax-advantaged accounts?

In most IRAs and other tax-advantaged accounts, you’re allowed to sell cash-secured puts and covered calls, as long as the account has enough collateral to fully back the trade. These are considered “defined risk” or “fully funded” strategies. What’s typically not allowed are margin-based trades, like naked calls or puts, or anything that requires borrowing.

This is because IRAs legally can’t use leverage. Some brokers do allow credit spreads or iron condors inside IRAs, but only if they’re entered as a single defined-risk order. As always, the exact rules vary by broker, so it’s worth double-checking their specific option approval levels for IRAs.

If IRAs have tax benefits, why do traders still use taxable accounts?

Because in a taxable account, you have something coveted by us Americans—freedom. While IRAs give you tax breaks, they also come with constraints. There is no margin, limited strategy access, and sometimes clunky execution rules.

In a taxable brokerage account, you can trade the full menu—naked puts and calls, ratio spreads, diagonals, straddles, iron condors, portfolio margin, and even day trading if you qualify.

Yes, you’ll owe taxes on gains. But, you can time your sales, carry forward losses, and even qualify for long-term capital gains treatment. For active or advanced traders, the flexibility is often worth the tax bill.

Also, it's not one or the other. Why not dabble in all 3 buckets?

Got any questions or comments? Feel free to reply to this email—we’d love to hear from you!

If you found this helpful, feel free to share or forward this email to anyone who might be interested! We appreciate your support.

Disclaimer

The information provided in this newsletter is sourced from reliable channels; however, we cannot guarantee its accuracy. The opinions expressed in this newsletter are solely those of the editorial team, contributors, or third-party sources and may change without prior notice. These views do not necessarily reflect those of the firm as a whole. The content may become outdated, and there is no obligation to update it.

Options come with inherent risks. We strongly advise you to consult with a financial advisor before making any investment decisions, including determining whether any proposed investment aligns with your personal financial needs.