- ThetaThrottle

- Posts

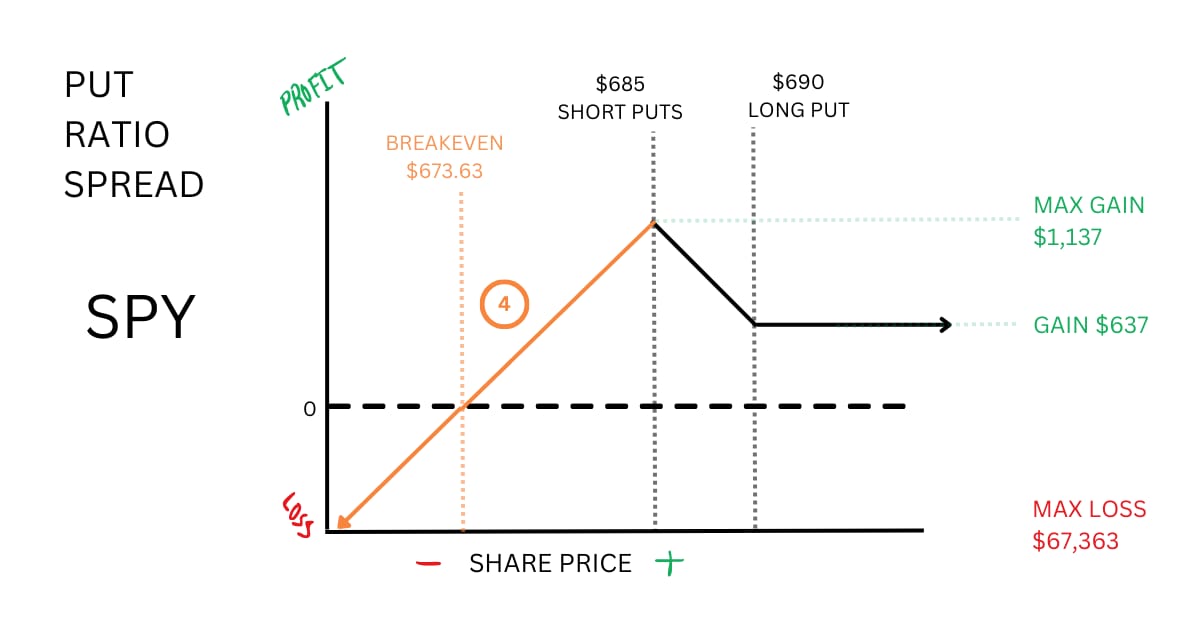

- Using Put Ratio Spreads

Using Put Ratio Spreads

Weekly Edition: January 21st, 2026

Market Movements

Current Level | Weekly Return | YTD | |

|---|---|---|---|

S&P 500 | 6,796.86 | -2.026% | -0.71% |

NASDAQ | 22,954.32 | -2.587% | -1.24% |

Dow Jones | 48,488.59 | -1.222% | 0.88% |

VIX | 20.09 | 23.025% | 34.38% |

Russell 2000 | 2,645.36 | 0.544% | 5.79% |

*Weekly Return is calculated as market open of the previous Wednesday, to market close this Tuesday (yesterday); Current Level is Tuesday’s (yesterday’s) close.

Weekly Rollout

Wall Street posts its biggest daily drop in three months

President Donald “Tariff” Trump is at it again, but the supreme court decision looms

Netflix stock sinks on earnings. It’s now ~22% below the 200-day MA

The EU is talking about tariffing US goods. Yikes

Bitcoin also slipped back down to about $90k

We’re about a week out, and it is very likely that rates go unchanged

“Good-To-Know’s”

Net Credit vs. Net Debit — This is whether a trade receives money or pays money at entry. It helps to clarify what must happen for the position to be profitable. It is relevant when using multi-leg strategies, and we need to get to the ‘net’ of all of the premiums.

A net credit trade pays you upfront. Most of the time, it works best when the stock doesn’t move much. The premium you collect helps offset small moves against you, but depending on the trade, losses can still grow if price moves too far.

A net debit trade costs money to enter. It usually needs the stock to move, volatility to increase, or both to make money. Because you pay upfront, losses are typically limited, but you need to be more right about timing and direction.

Net credit does not mean lower risk, and net debit does not mean safer. The distinction simply highlights whether the trade is being paid to wait or paying to move.

This shouldn’t necessarily be used as a gauge of quality.

To All Theta Throttle Subscribers

This is the 52nd weekly edition of Theta Throttle, which means we’re at about a year of doing this. I just wanted to say thank you to each and every reader. It is surreal that I have been creating these for a full year now. I hope you all have found value. Looking forward to many more years ahead.

Quote(s) I Like

"Competition is overrated. In practice it is quite destructive and should be avoided wherever possible. Much better than fighting for scraps in existing markets is to create and own new ones."

“Success in investing is not about being right all the time. It’s about minimizing losses and maximizing gains.”

Thought Throttle

Not all downside risk is created equal.

Some stock losses happen slowly. Others happen unbelievably fast.

There are ways to profit on these slow declines, particularly when we have a rough price target below the current price.

One tested method is a Put Ratio Spread, a.k.a., a ‘1x2 ratio put vertical spread’ or ‘short put ratio. ‘

What is this technically?

This structure is created by selling 2 puts at a lower strike and buying 1 put at a higher strike, both with the same expiration. It can be conceptualized as a short put (either CSP or naked) paired with a Put Bear Spread, or Put Debit Spread.

The trade can be entered into either as a net credit or a net debit. The payoff would look like one of these:

So why not just use a CSP or a Put Debit Spread?

Our 1x2 Put Ratio Spread is a better alternative when a downside movement is anticipated, but we don’t believe it will be fast or catastrophic.

This will become clear in an example:

Let’s look at SPY, which, at the time of writing this, sits at about $691.66.

For the example, assume we buy the 20 Feb ‘26 $690 put option for $9.37. We then sell 2 contracts of the 20 Feb ‘26 $685 put option for $7.87 each ($15.74 total). This leaves us with a net credit of $6.37 ($15.74 - $9.37).

At expiration, the outcome of this trade depends entirely on where SPY finishes relative to our strikes. There are four meaningful scenarios.

1. If SPY Finishes Above $690…

Both puts expire worthless. The $690 long put and the two $685 short puts have no intrinsic value.

The entire structure collapses harmlessly. And, we get to keep the full $6.37 credit.

This could be from the anticipated downside never materializing, leaving theta to do all of the work.

2. If SPY finishes between $690 and $685…

The trade begins to live up to what we expected. The $690 long put gains as price drifts lower, while both $685 short puts remain out of the money and expire worthless.

The credit collected at entry is still fully retained, plus we get the gains from the long put.

Just as an example, if SPY finishes at $688, the long put is worth $2.00. This stacks on top of the original $6.37 credit for a total profit of $8.37. This represents time decay and modest downside movement working to our favor.

3. If SPY finishes exactly at $685…

The trade reaches its maximum profit. Let’s go.

At this level, the $690/$685 put spread is worth its full $5.00, while both $685 short puts expire worthless.

When combined with the original $6.37 credit, the total profit is $11.37. This is the ideal outcome. A slow, orderly decline that stalls near the short strike.

4. If SPY finishes below $685…

The character of the trade changes, but not abruptly.

Once price moves below $685, the $690/$685 put spread has already reached its maximum value of $5.00 and no longer gives us additional protection.

From this point forward, the position behaves like a short $685 put—with the key distinction that it’s offset by the profit already earned. Every additional dollar SPY falls below $685 reduces profit by $1.00 per share.

Because the trade generated $11.37 of maximum profit, the true downside breakeven sits at $673.63. Above that level, the trade remains profitable. After that, it can be looked at as either a cash secured put (or naked short put) on a declining stock.

Again, the importance of picking a fundamentally solid stock cannot be stressed enough.

Why the Put Ratio Spread over the CSP?

Selling the $685 cash-secured put brings in $7.87 of premium, more than the $6.37 credit from the ratio spread. Below $685, that premium is the only buffer against further downside.

The put ratio spread gives up some upfront credit, but in return it reaches a much higher maximum gain of $11.37 at $685. That larger profit acts as a deeper cushion, allowing SPY to fall further below $685 before losses begin to matter.

Why the Put Ratio Spread over the Vertical Put Spread?

Compared to the $690/$685 vertical put spread, the difference shows up on the reward side. That spread costs about $1.50 and can make at most $3.50, and only if SPY finishes at or below $685.

The put ratio spread, by contrast, reaches a maximum profit of $11.37 at $685 and is designed to perform best if price stalls or drifts lower into that level, rather than breaking sharply below it.

All In All…

Put ratio spreads aren’t better or worse than other structures. They’re situational. They work best when slight downside is probable, but unlikely to be fast or disorderly.

We also need to note that the examples above use mid-prices and focus only on expiration outcomes, not the path the trade may take before then. Real trades evolve. Volatility shifts. Liquidity matters.

Decisions still have to be made and discipline is required.

This is for educational purposes only—not a trade recommendation. Remember to always do your own due diligence and consult a financial advisor before making investment decisions.

Throttle Q&A

Does this trade have to be held until expiration?

Not necessarily.

Expiration payoff diagrams and simplified examples are useful for understanding how the structure behaves, but they aren’t a holding requirement.

Trades commonly change character before expiration. The risk–reward profile can be altered in a way that justify adjustments or exits well ahead of the final date.

Don’t Forget the Fundamentals

Simply, don’t forget the foundation of fundamental analysis.

Options amplify a view—they don’t replace one. Without conviction in the balance sheet and business quality, selling premium is just hope-fueled guesswork.

You have to do the work. Your portfolio depends on it. Disregard this at your own peril.

Got any questions or comments? Feel free to reply to this email—we’d love to hear from you!

If you found this helpful, feel free to share or forward this email to anyone who might be interested! We appreciate your support.

Disclaimer

The information provided in this newsletter is sourced from reliable channels; however, we cannot guarantee its accuracy. The opinions expressed in this newsletter are solely those of the editorial team, contributors, or third-party sources and may change without prior notice. These views do not necessarily reflect those of the firm as a whole. The content may become outdated, and there is no obligation to update it.

Options come with inherent risks. We strongly advise you to consult with a financial advisor before making any investment decisions, including determining whether any proposed investment aligns with your personal financial needs.