- ThetaThrottle

- Posts

- How To Read The Chain

How To Read The Chain

Weekly Edition: January 14th, 2025

Market Movements

Current Level | Weekly Return | YTD | |

|---|---|---|---|

S&P 500 | 6,963.74 | 0.269% | 1.73% |

NASDAQ | 23,709.87 | 0.701% | 2.01% |

Dow Jones | 49,191.99 | -0.648% | 2.35% |

VIX | 15.98 | 6.890% | 6.89% |

Russell 2000 | 2,633.10 | 1.836% | 5.30% |

*Weekly Return is calculated as market open of the previous Wednesday, to market close this Tuesday (yesterday); Current Level is Tuesday’s (yesterday’s) close.

Weekly Rollout

Markets pause near record highs as earnings roll in

Why does the market not seem to care about Jerome Powell’s investigation?

Trump is ready to cap credit card rates

Silver just keeps on chugging

Wall Street is expecting a strong Q4 earnings

SPY’s volatility is super suppressed (14th Percentile)

“Good-To-Know’s”

Implied Volatility (IV) Skew — This is when IV differs across different option strikes and can be used to gauge what the market thinks will happen.

The most common shape in equities is negative (or reverse) skew, where out-of-the-money puts carry higher IV than calls. Downside moves tend to happen faster and be more damaging. Options price this in.

A positive (or forward) skew flips this relationship, with calls priced richer than puts. In this circumstance, markets are pricing in more of an upside shock.

A volatility smile occurs when both calls and puts away from the money trade with higher IV than at-the-money options, signaling broad uncertainty. Occasionally, skew can appear relatively flat—the market may be movement agnostic.

Don’t think of skew as a prediction, but as the market’s way of highlighting what and how outcomes are priced.

Quote(s) I Like

“Any man who claims to know what the market is going to do any more than to say that he thinks this or that will occur as a result of certain specified conditions is unworthy of trust as a broker.”

“Why should it be easy to do something that, if done well, two or three times, will make your family rich for life?”

Thought Throttle

If learning about options can be tricky, then figuring out what the options chain means is downright difficult.

At first, anyway.

That difficulty is short-lived with a little time and practice. What should we look for?

Let’s dive in.

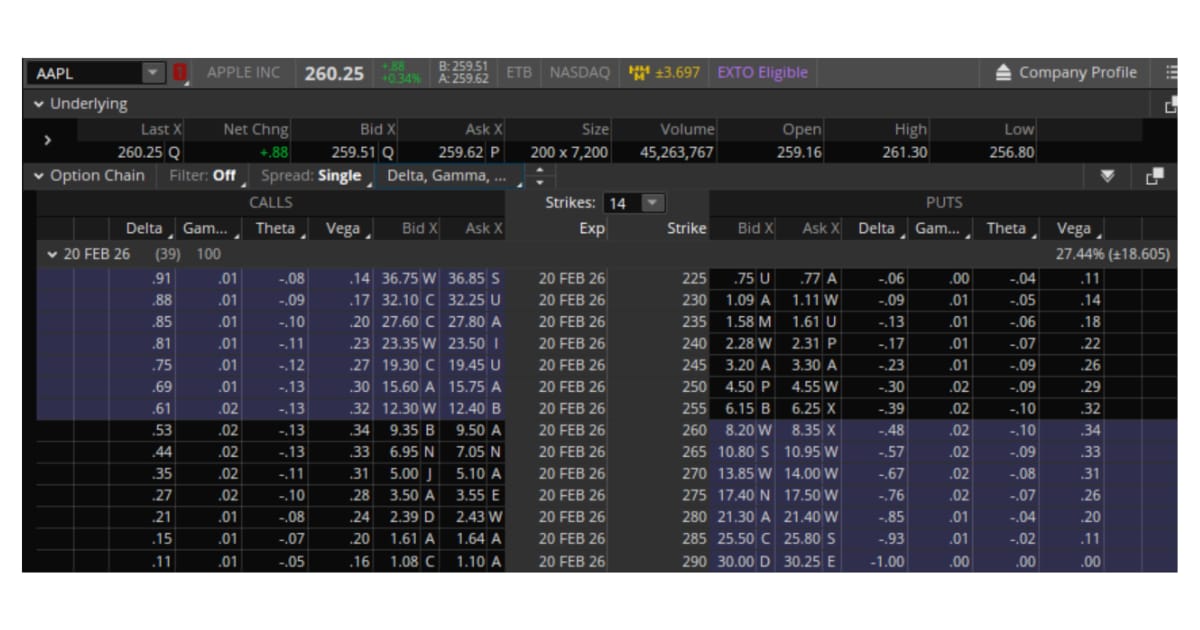

We’ll use Thinkorswim, but most options chains are fairly similar. This is Apple (AAPL).

Up first, we’ll look at the expirations:

Beside the expiration date, in parentheses, you’ll see the Days until Expiration (DTE), the shares per contract (All are 100 shares, which is the standard contract), and whether or not it is a weekly option (yellow). This quickly tells you how much time you’re selling and what type of expiration you’re dealing with.

On the far right, the percentage shows the at-the-money implied volatility for that expiration, while the number in parentheses is the market’s expected dollar move. It’s not a forecast, but a snapshot of how much movement is currently being priced in.

Once we select our expiration:

This is 20 Feb ‘26 chain, with calls on the left, puts on the right, and strike prices down the middle. The strikes closest to the current stock price (~$260) are at-the-money, where activity is typically highest. Blue shading indicates In-The-Money (ITM).

A lot of information is displayed on each row (or strike), like volume (contracts traded today), open interest (existing positions), bid/ask prices (current market quotes), and implied volatility (how much movement is being priced in).

The bid–ask spread is especially important. It reflects how easily you can enter or exit at a fair price. Check out this article for more on bid-ask spreads:

As strikes move further from the stock price, liquidity tends to thin out, spreads widen, and implied volatility shifts.

This layout helps you quickly see where trading is concentrated and how risk is being priced.

Options chains are highly customizable.

This layout includes different columns. We can see the Greeks, alongside the bid/ask prices.

We’re not here to focus on each of the Greeks (each one could have its own newsletter edition), just to highlight alternatives. Some traders prefer a simplified price-only view, while others want a screen full of numbers.

The goal is consistency and clarity. The chain should be a tool, not a distraction.

So how is this useful?

The purpose becomes simple quickly. Filter out anything yucky.

Start with liquidity. We like tight bid–ask spreads and consistent volume across strikes. Look for where the volume clusters and how open interest is spread across strikes. Smooth, evenly distributed OI is much simpler than isolated pockets.

Take a quick glance at the Greeks. Again, entire articles could be done on each of the Greeks. But for today’s purposes, check that nothing looks extreme or inconsistent. Sudden jumps in delta or unusually high gamma near expiration are worth noting.

Watch for abnormalities. Volume that absolutely dwarfs open interest, sharp IV differences across nearby strikes (remember IV Skew), or oddly shaped chains often point to short-term activity or pricing distortions.

Be careful, since market irrationality can both make you money, or make you uncomfortable.

Do what you can for your portfolio. Avoid the avoidable friction.

Trade Mechanics

The Cash-Secured Put

NVIDIA (NVDA) is currently trading around $185.81. If we’d like to own shares at a lower price, we could sell the 20 Feb ‘26 $175 put (~28 delta) and collect about $4.05 in premium.

If NVDA stays above $175 through expiration, the option expires worthless and we keep $405 in income. A return of 2.37% in 38 days, which annualizes to ~25.2%.

If NVDA drops below the strike, we’d be assigned 100 shares at $175, giving us an effective cost basis of $170.95 after premium.

Simple, defined, and patient.

2.0 Version

The Covered Strangle.

If we already own 100 shares of NVDA and wouldn’t mind selling at a higher price, we could pair the short put with a covered call. Selling the 20 Feb ‘26 $200 call (~27 delta) brings in an additional $3.15 in premium.

This brings total collected premium to $7.20, or $720 per 100 shares.

At expiration, if NVDA is:

Below $175 → we buy more shares at $175 and keep the full premium

Between $175 and $200 → both options expire worthless; we keep the entire $720

Above $200 → we sell our existing shares at $200 and still keep the premium

The structure collects income from both sides of the market, but it comes with tradeoffs. Downside risk still exists, and upside is capped in exchange for premium.

Stay sized appropriately, understand the obligations, and let time do the work.

This is for educational purposes only—not a trade recommendation. Remember to always do your own due diligence and consult a financial advisor before making investment decisions.

Throttle Q&A

Is Higher Implied Volatility Always Better for Option Sellers?

Not necessarily.

Higher implied volatility means options are priced more expensively, which results in larger premiums. However, that pricing reflects the market’s expectation of larger or faster price movement.

There’s no free lunch. Premium size is largely a reflection of risk. Additional premium comes with increased uncertainty.

Implied volatility tells you how much movement the market expects, not necessarily whether selling is a good deal.

Why Do Some Deep ITM Options Trade So Poorly?

As options move deeper in the money, liquidity tends to decline, and bid-ask spreads widen.

Fewer traders actively quote these contracts, which makes execution less efficient, even though the option has significant value.

Trading activity shifts toward strikes closer to the current stock price.

Got any questions or comments? Feel free to reply to this email—we’d love to hear from you!

If you found this helpful, feel free to share or forward this email to anyone who might be interested! We appreciate your support.

Disclaimer

The information provided in this newsletter is sourced from reliable channels; however, we cannot guarantee its accuracy. The opinions expressed in this newsletter are solely those of the editorial team, contributors, or third-party sources and may change without prior notice. These views do not necessarily reflect those of the firm as a whole. The content may become outdated, and there is no obligation to update it.

Options come with inherent risks. We strongly advise you to consult with a financial advisor before making any investment decisions, including determining whether any proposed investment aligns with your personal financial needs.